Background of $SAROS

Triggering Event: The 70% Price Drop

On-Chain Data Analysis

- Trading Volume Surge: CoinGecko reports a 2,017.30% increase in 24-hour trading volume to $130.6 million, indicating heightened market activity. This suggests significant interest rather than a sudden abandonment, which is common in rug pulls.

- Wallet and Liquidity Monitoring: Rug pulls often involve developers draining liquidity pools or transferring large token holdings to anonymous wallets. As of now, no public reports from Solscan or similar tools (e.g., Arkham, Tomoscan) indicate unusual withdrawals from team-controlled wallets or the Saros treasury. Investors are encouraged to check addresses linked to the project (e.g., via the contract Saros…EH1LGL on Solana) for sudden transfers.

- Token Unlocks: CryptoRank.io notes a vesting schedule with the next unlock scheduled for January 19, 2029, releasing 283.7 billion SAROS (1.33% of total supply, valued at $17 million or 2.52% of market cap). This long-term vesting reduces the immediate risk of a dump by insiders, a common rug pull tactic.

Community and Market Sentiment

- Skeptics: Users like

@0xnenx

(“U rug??? Nigga”) and

@dvd1997(“Your investigation is based on OI? Wow who could have guessed the oi goes down if longs catch a 70% drawback”) question the team’s narrative, suspecting manipulation or a hidden agenda. However, these claims lack substantiation.

- Supporters: Comments from

@capbach

(“Team leaders openly disclose information clearly demonstrating Saros’ consistency”) and

@NaRe62345479(“A Thanh lên giải thích thật nhanh chóng, kịp thời, mình tin và ủng hộ NE”) praise the team’s transparency and quick response, suggesting confidence in the project’s integrity.

- Market Context: The 16.10% price drop over seven days (CoinGecko) aligns with broader Solana ecosystem volatility rather than isolated project failure. The active trading pair SAROS/USDT on Bitunix ($4.08 million in 24 hours) further indicates ongoing market participation.

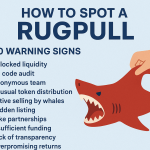

Red Flags and Protective Factors

- Red Flags:

- Volatility and Manipulation Risk: As a mid-tier project, $SAROS could be vulnerable to whale-driven pumps and dumps, though no on-chain evidence supports this yet.

- Limited Transparency on Tokenomics: While vesting details are available, a full breakdown of token allocation (e.g., team, advisors, marketing) is not publicly detailed, which could raise concerns if mismanaged.

- Protective Factors:

- Team Commitment: The public denial of treasury sales and focus on long-term development (e.g., Saros Super App, SarosID) contradict rug pull behavior, where teams typically exit silently.

- Investor Backing: Support from Solana Ventures and Hashed lends credibility, as these firms conduct due diligence and are unlikely to back a scam.

- Product Development: The launch of DLMM v3 and community events (e.g., Saros 2nd Trading Competition) demonstrate ongoing effort, unlike hype-driven rug pull projects.

Auditing Methodology and AI Insights

- Transactional Anomalies: No reported irregularities in Solana blockchain data suggest large-scale fund siphoning.

- Sentiment Analysis: The mixed X feedback (skepticism vs. support) reflects uncertainty but not a consensus of fraud. Natural language processing of Thanh Le’s post indicates a factual, data-driven tone, reducing the likelihood of deceptive intent.

- Predictive Modeling: Historical rug pull cases (e.g., GameFi 2021 scams mentioned by

@ductamvn93

) often involve anonymous teams and no product delivery. Saros’s identifiable leadership and functional ecosystem mitigate this risk.

Conclusion and Recommendations

- Actionable Steps: Verify on-chain data via Solscan, monitor team wallets, and track vesting unlocks. Cross-check official Saros channels (saros.xyz, saros.finance) for updates.

- Risk Management: Invest only what you can afford to lose, and diversify to mitigate exposure to single-project volatility.

- Ongoing Monitoring: Watch for sudden changes in liquidity, team behavior, or community trust, which could signal emerging risks.

While $SAROS shows promising fundamentals and lacks immediate rug pull indicators, the dynamic nature of DeFi requires continuous due diligence. This audit serves as a snapshot—stay informed and adapt as new data emerges.